The Problem:

Quantitative market research requires the development and fielding of a survey that contains closed ended questions developed by the researchers designing the survey. To assist researchers in the analysis, they frequently include opened questions to solicit comments from respondents designed to help in the interpretation and analysis of the closed ended questions in the survey.

The challenge with this approach is that the comments provided by respondents are many times used to support or add ‘color’ to the analysis of closed ended answers, NOT to provide deeper insights into actions clients should consider taking. This approach can lead to less robust analysis of the results as well as sub-optimal insights and actionability of the research itself.

Why a Solution Matters:

Current approaches to collecting and analyzing unstructured text from survey research and social media sources have met with limited success, and frequently provide no clear direction to help inform business decisions. They can at best provide some general direction, but no specificity to drive sound business decisions.

Applying our proprietary approach to the Highly Competitive Streaming Services Marketplace:

Pathfinder Analytics, sister company to MAi Research has developed an approach using Natural Language Understanding to glean nuance from text (in context understanding of words) which can be combined with certain closed ended measures to deepen the understanding of text enabling clients to develop specific messaging to drive desired behaviors more directly.

Pathfinder worked with MAi Research to design, field and analyze research conducted among more than 1,100 respondents on the highly competitive video streaming services marketplace utilizing this approach. The approach combines Artificial Intelligence AND Human Experience to analyze and gain insight from unstructured text.

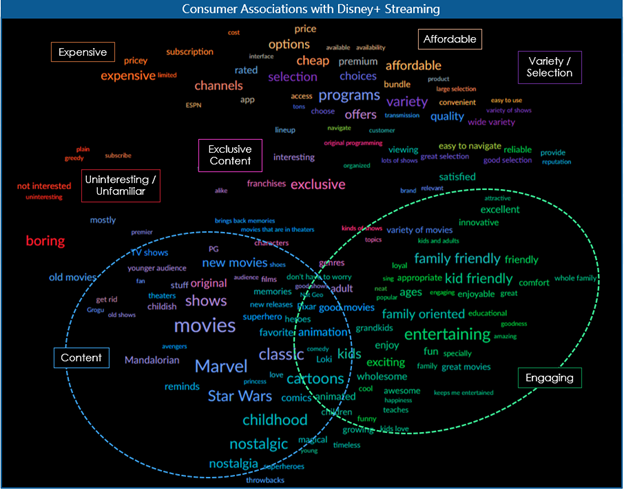

Several top video streaming services were included in our research. Our exploration of consumer perceptions of the relatively new Disney+ streaming service for example reveals two major strengths: a strong content library (in blue) featuring both the Marvel and Star Wars IPs, as well as a powerful set of brand associations (in green) rooted in Disney’s legacy as a family friendly content provider:

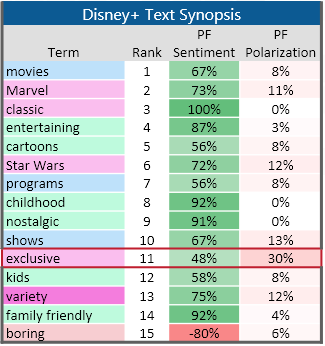

Further analysis takes the form of our proprietary Text Synopsis summary, which shows the relative prevalence, match count, consumer sentiment, and level of polarization for every word on the map:

The strength of terms like Marvel, Star Wars, and exclusive on the Text Synopsis reveals how effectively Disney+ has positioned itself as a provider of exclusive content — however, the lower sentiment (48% positive) and higher polarization (30%) of the term exclusive also suggests that, for at least some consumers, this emphasis on exclusive content may be more of a barrier than an enticement.

Further details on our approach, and the results of this research will be presented at Quirk’s NYC on November 2:

Also, look for more findings from this research in subsequent posts.

For more about our firm and how we support our clients, please visit www.mairesearch.com